Page 3 - 20 03 31 COVID-19 Response Report FINAL

P. 3

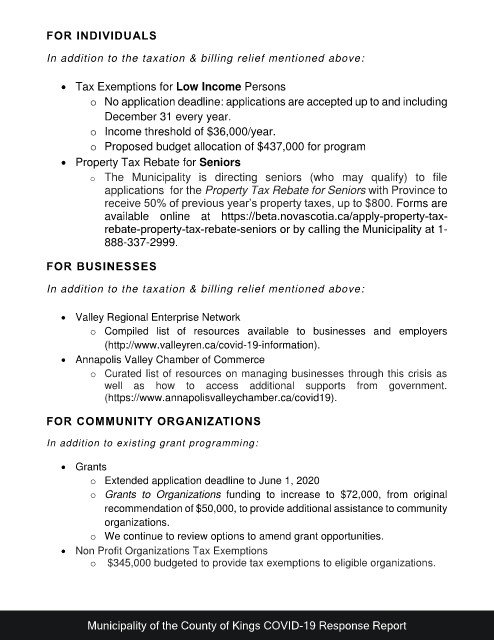

FOR INDIVIDUALS

In addition to the taxation & billing relief mentioned above:

Tax Exemptions for Low Income Persons

o No application deadline: applications are accepted up to and including

December 31 every year.

o Income threshold of $36,000/year.

o Proposed budget allocation of $437,000 for program

Property Tax Rebate for Seniors

o The Municipality is directing seniors (who may qualify) to file

applications for the Property Tax Rebate for Seniors with Province to

receive 50% of previous year’s property taxes, up to $800. Forms are

available online at https://beta.novascotia.ca/apply-property-tax-

rebate-property-tax-rebate-seniors or by calling the Municipality at 1-

888-337-2999.

FOR BUSINESSES

In addition to the taxation & billing relief mentioned above:

Valley Regional Enterprise Network

o Compiled list of resources available to businesses and employers

(http://www.valleyren.ca/covid-19-information). or-businesses/)

Annapolis Valley Chamber of Commerce

o Curated list of resources on managing businesses through this crisis as

well as how to access additional supports from government.

(https://www.annapolisvalleychamber.ca/covid19).

FOR COMMUNITY ORGANIZATIONS

In addition to existing grant programming:

Grants

o Extended application deadline to June 1, 2020

o Grants to Organizations funding to increase to $72,000, from original

recommendation of $50,000, to provide additional assistance to community

organizations.

o We continue to review options to amend grant opportunities. /)

Non Profit Organizations Tax Exemptions

o $345,000 budgeted to provide tax exemptions to eligible organizations.

Municipality of the County of Kings COVID-19 Response Report